Getting started with Section 321.

For Modern DTC Fashion Brands. Learn more about Section 321 and how you can use it to your competitive advantage.

%202.png)

What is Section 321?

Section 321 is the legislation that describes de minimis. A de minimis shipment, or Section 321 shipment, is a shipment that allows for goods valued at 800 USD or less to be imported duty-free into the United States.

A Section 321 shipment must not be a part of lots from a larger order and there is also a one shipment per day limit. Simply put, you can't split a larger shipment into smaller ones to avoid the de minimis fee of 800 USD. Section 321 clearance is beneficial since there is not a lot of paperwork which allows for faster customs processing.

The de minimis was originally 200 USD but this was increased to 800 USD in February 2016. This change made the program much more attractive to Direct to Consumer brands looking to make shipping from Canada/Mexico into the USA custom-free while saving on duties and tariffs.

There are some goods that cannot be released as section 321. The following require inspection and are prohibited:

- Chemicals or Hazardous Materials

- Goods regulated by the FDA, FSIS, NTSA, or USDA

- Alcohol and Tobacco

On October 1st, then-President Trump enacted Section 301 which added additional tariffs to Chinese goods, as much as an additional 7.5% on top of already hefty tariffs (28.5%). At the time of writing, President Biden has no plans on removing these additional Chinese Tariffs.

As long as the high tariffs remain, Section 321 is a clear advantage for importers to save on costs.

What does Section 321 mean for consumers?

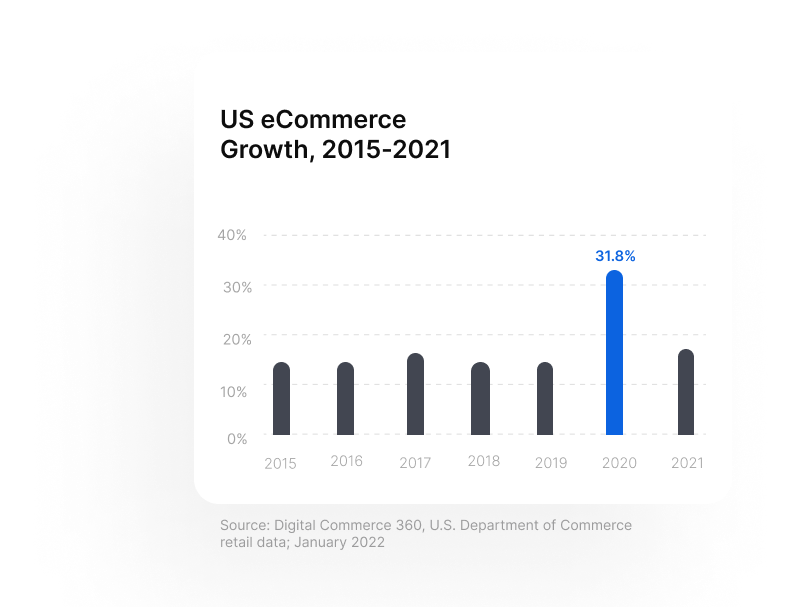

The surge in online shopping caused by Covid-19 shows no signs of slowing down as consumers acclimate to a new post-Covid world. As far as consumers are concerned, there is no different experience in receiving a package from Canada or Mexico than if it came from the United States. The duties are prepaid, there is minimal latency added to transit times and returns are processed the same as if the goods came from within the United States.

What does Section 321 mean for DTC brands?

If you're a brand, you might wonder how Section 321 can help your business and whether it's worth shipping your goods to Mexico or Canada. Here are some ways that Section 321 can give you a competitive advantage.

While many DTC brands can save money importing into Canada or Mexico and then shipping into the USA, the biggest savings are with Apparel and Footwear brands manufacturing in Asia.

Lower costs of importing goods into the United States.

Let’s take for example a simple Men’s T-Shirt made of man-made fibers manufactured in China. This T-Shirt would incur a tariff of 32% coming into the United States. The same T-Shirt imported to Canada or Mexico and then sent to the USA under Section 321 to a US consumer would incur ZERO tariffs. This savings comes off the bottom line and is an immediate 32% savings.

Faster shipments.

Most cross-border fulfillment providers take advantage of The US Customs And Border Protection (CBP) revamped Automated Commerce Environment (ACE) platform to reduce manual processes and paper submissions. This allows the more than 2 Million daily Section 321 shipments to be processed faster and more efficiently.

High-level process review.

It’s important to dive deeper into how this process works:

Canada/Mexico Customs Broker

Duty and GST/VAT is paid on entry to Canada/Mexico. Importer registers for GST/VAT and is refunded the GST/VAT portion on a later filing.

Canada/Mexico 3PL

Receives stock, picks US Orders, manifests the data for the 321 entry either (i) with the carrier; or (ii) directly with CBP.

US Customs (CBP)

Receives manifest from either carrier or Canada/Mexico 3PL. Driver crosses with the ACE Manifest for the load, and Commercial Invoices < $800. Goods enter duty free and MPF free.

Canada/Mexico Customs Broker

Files monthly drawback with CRA of duty paid in Step 1, linking the inbound and outbound entries. Effectively the goods are in the hands of the US consumer, duty free.

%201-min.png)

Both Canada and Mexico also have duty relief programs wherein any duties due upon importation to Canada or Mexico are postponed for 90 days. If the goods are shipped into the United States within those 90 days then no duties are due. While this program requires a bit more paperwork and government oversight, it is much more advantageous to not pay the duties upon import than pay them and wait for the Government to refund those monies initially paid upon importation.

Let’s assume how much you can save and take footwear as an example:

Your pain? We understand. This is why we do what we do, and can provide you with an experience like no other.

| Selling price |

USD $95.00 |

|---|---|

|

Cost of shoe |

USD $30.00 |

|

US MPF (merchandise Processing Fees) |

0.3464% |

|

US Duty Rate (HTS 6404.11.90) |

35% |

|

Canada/Mexico Duty Rate Not relevant, since paid on import and refunded on export |

18% |

|

Avg. Shipping Cost within US |

USD $6.00 |

|

Avg. Shipping Cost from CA/MX (Assumed to include linehaul and 321 manifesting fees) |

USD $10.00 |

Now let’s look at the savings:

Your pain? We understand. This is why we do what we do, and can provide you with an experience like no other.

| Duty Saved |

$30 x 35% = $10.50/unit |

|---|---|

|

MPF Saved |

$30 x 0.3464% = $0.10/unit |

|

Incremental Freight |

$10.00-6.00 = $4.00/order |

Net savings: USD$6.60/unit or 6.95% of sales ($95).

How to get started.

Now that you've decided to use Section 321 to take advantage of the massive tariff savings, you're probably wondering how to get started. It sounds complicated, and it is if you try to go at it alone. Compliance Issues, commercial invoices, manifests, restrictions to 321, receiving 321 shipments, duty filings, drawbacks, & VAT/GST taxes. It can definitely be overwhelming.

Luckily, ChannelApe and its best-in-class warehouse partners both in Canada and Mexico have streamlined the processes so launch can be less than 30 days.

Let's get started and walk through some steps to a successful Section 321 strategy.

Doing business in Canada or Mexico.

One of the first steps to get started shipping from either Mexico or Canada is to set up registries/licenses with the in-country governments for taxation purposes. This is the first step and it can take some time –and anyone who has worked with foreign governments can attest to this.

We recommend scheduling time with your accountant and attorney to make sure all the forms are filled out correctly. Some example forms that will need to be filled out for non resident importers in Canada are below.

Canada setup.

-

POA

This is a Power of Attorney Form to prove that the warehouse has permission to clear goods on your behalf.

-

Request for Business Number(BN)

This is for a company that has not imported into Canada using its own company’s name before. This form also includes a GST application.

-

Agreement to Maintain Records Outside of Canada

If you intend to keep your customs records at your office outside of Canada, please use this form for permission to do so. Please complete this after you have your Business Number(BN)

-

Master Carrier Authority:

We provide this form to carriers to prove who your Customs Broker is in Canada.

-

Doing Business in Canada - GST-HST - Non Residents

This document explains how the Canadian Goods and Services Tax/Harmonized Sales Tax (GST/HST) applies to non-residents doing business in Canada. You can refer to this document, but here is more "down to it earth" explanation of Canadian sales taxes. GST stands for Goods and Service Tax and HST stands for Harmonized Sales Tax. GST is a federal tax and applies to all the provinces and territories that are listed below with a 5% beside their name. HST is a combination of the GST and the Provincial Sales Tax. Some Provinces use HST and others charge GST plus PST (Provincial Sales Tax) instead. GST is always 5%, but since Provincial Sales Taxes vary, the HST rates vary.

-

Master Carrier Authority:

We provide this form to carriers to prove who your Customs Broker is in Canada.

-

Doing Business in Canada - GST-HST - Non Residents

This document explains how the Canadian Goods and Services Tax/Harmonized Sales Tax (GST/HST) applies to non-residents doing business in Canada. You can refer to this document, but here is more "down to it earth" explanation of Canadian sales taxes. GST stands for Goods and Service Tax and HST stands for Harmonized Sales Tax. GST is a federal tax and applies to all the provinces and territories that are listed below with a 5% beside their name. HST is a combination of the GST and the Provincial Sales Tax. Some Provinces use HST and others charge GST plus PST (Provincial Sales Tax) instead. GST is always 5%, but since Provincial Sales Taxes vary, the HST rates vary.

-

Canada Customs Invoice:

This form, called a CCI, is used by the Importer to declare the items and their value that you are shipping into Canada. This form is not necessary if a commercial invoice is used and it has all seven of Canada's requirements (Vendor, Importer of Record, consignee, detailed description, country of manufacture, unit price,and currency).

Usually, a business number for importing can be generated in a few days, but a GST one can take up to 4 weeks for the paperwork to be finalized. A GST number is only needed if selling to Canadian customers. If you are starting with selling only to US customers to take advantage of Section 321 a GST number is not required.

Mexico setup.

Companies looking to import or export from Mexico must register in the Federal Taxpayers Register (Registro Federal de Contribuyentes). Registration with the RFC allows companies to:

- Issue electronic invoices (known as CFDI).

- Apply for certificates and permits.

- Complete customs formalities.

- Apply for tax rebates.

- Obtain an electronic signature, which is required to use the Mexican Digital Window for Foreign Trade (Digital Window).

- Register to the Importers’ Registry or Exporters’ Registry.

Companies that import or export will require specific documentation that their warehouse will provide. Of special note, Footwear and Apparel imports to Mexico require registration in a special importers or exports registry.

Carrier setup.

To reduce transit delays, orders are consolidated and trucked to a local induction point in the United States. Buffalo, Detroit, Cincinnati, San Diego and Laredo, Texas are all common border crossings for Section 321 entries. Consolidated shipments are delivered straight to the carriers, FedEx, UPS, USPS, or DHL. This allows for fast delivery times and no change in your customers' experience.

Your warehouse provider will generate the commercial invoice at no additional charge. A commercial invoice is a document that provides information to the customs border protection unit (CBP) detailing country of origin, HTS codes, and product description including quantity, value of shipment, receiver’s information, and the signature of the exporter.

Reverse logistics.

As a brand selling to consumers online, returns are a key component of the sales cycle. Reverse logistics can function much the same way they do if you shipped from the USA. Many brands today use a returns platform to make the refund process easier. Brands can use their current return provider, whether it be Loop Returns, Returnly, or Happy Returns and returns can be sent back to the origin of shipment in Canada or Mexico to be added back into inventory for resale.

Suggested reverse logistics flow for apparel and footwear brands.

Apparel and Footwear brands oftentimes have very high return rates of high-value seasonal goods. Returns coming from the United States are usually consolidated at the border by the CA/MX warehouse and then brought back to the facility for processing. Returns are not usually a high priority for most facilities and this process can not only take weeks but can also be expensive when you factor in freight charges and labor on items that many times will be disposed of.

What ChanneApe offers is to direct returns to one of our Reverse Logistics QA partners in the United States. Returns are processed quickly by a facility that is adept at handling high-volume returns and refurbishment of goods. This process cuts down on not only return freight charges, but also gets products back into inventory much faster –an important strategy if your items have seasonality.

Once items are determined to be in resalable condition, they are placed back into inventory and ChannelApe can update your sales channels. If the goods are available at the reverse logistics partner when an order is placed for that item, that order is given priority and will be shipped as new stock from within the USA.

ChannelApe's platform can act as a decision-making engine for this functionality, determining where an order is shipped from, whether it's from a warehouse in Canada or Mexico, or from a QA provider in the United States.

Items not in resalable condition can be donated or destroyed according to brand specifications without having to travel back to Mexico or Canada.

Shopify setup (optional).

The below setup would be for a brand looking to also sell within Canada or Mexico and have two domains. One domain for the United States and another domain within CA or MX to take advantage of that country's consumers.

If you're selling and your site is built on Shopify, moving your fulfillment to Canada or Mexico to take advantage of section 321 requires just minor changes. Shopify connects directly to ChannelApe with a Shopify App. ChannelApe then connects to your fulfillment provider to route orders and returns to the correct warehouse.

At most, we see some brands copy their USA Shopify site using apps like Rewind or with the help of their Shopify Account Manager. The new site would have the domain .ca or .mx to take advantage of selling to consumers in the country where the fulfillment center is located. Canadian and Mexican consumers are 4 times more likely to purchase from a .ca or .mx domain because they know they are getting charged in local currency and the brand has a presence in Canada or Mexico (a requirement for the domain registration).

Banking/currency considerations.

Most 3PL providers internationally will want to be paid in local currency. Providers will be accommodating and invoice warehouse fees in USD if required, however, the exchange rate is not always favorable, and a margin is added to mitigate their risk of currency fluctuations. It is usually more advantageous for the brand to open a multi-currency bank account to buy local currency to pay invoices themselves.

Conclusion.

We want to make this easier for you. That’s why we’ve invested the time to help brands like yours navigate Section 321 and the challenges of e-commerce effectively.

Cutting costs is just as crucial as increasing revenue and offering a great customer experience. And as a brand, knowing international shipping and trade legislation can change the way you do business. Section 321 eliminates a significant amount of taxes and fees –so enabling items to be imported will help to retain any profits made.

It’s important to keep in mind that businesses can gain an edge by providing speedy shipment to consumers, while saving money. This is why many companies hire a reputed 3PL provider to guarantee that importing is well-coordinated.

You don't have to go it alone when it comes to cross-border shipping. Contact us to learn more about how ChannelApe can help your business.

You don't have to do it alone when it comes to cross-border shipping. Contact us to learn more about how ChannelApe can help your business.